Student Loan Debt: Major Barrier to Entrepreneurship

Thursday, October 15th, 2015

The majority of all new jobs in the U.S. are created by startups and small and medium-sized businesses -- and that entrepreneurial engine has slowed down considerably.

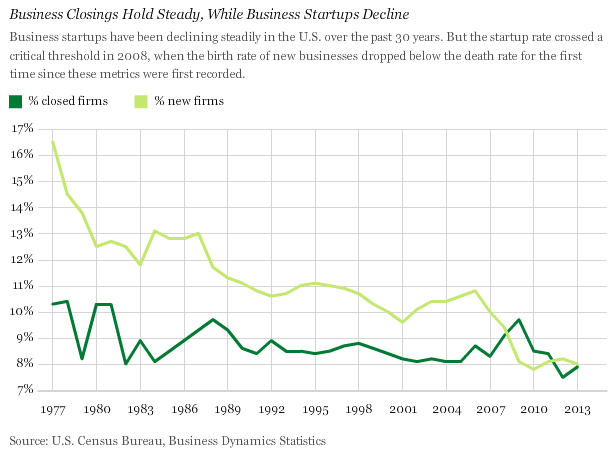

The U.S. Census Bureau reports that the lines for the total number of business startups and business closures per year -- the birth and death rates of American companies with one or more employees -- crossed for the first time in 2008. In the nearly 30 years before that, the U.S. consistently averaged a surplus of almost 120,000 more business births than deaths each year.

But from 2008 to 2011, an average of 420,000 businesses were born annually nationwide, while an average of 450,000 per year were dying. The deaths of businesses during this time outnumbered the births of businesses.

There is good news: The most recent data for 2012 and 2013 show that we are now back to a positive scenario, with more business births than deaths. But this is still a far cry from the average of 120,000 new businesses created each year from 1977 to 2007.

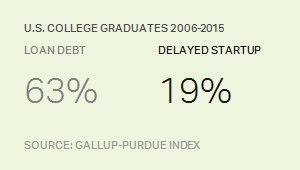

To make matters worse, the country can't look to people coming out of college to reverse this trend because too many of them are strapped by student loan debt. Results of the 2015 Gallup-Purdue Index -- a study of more than 30,000 college graduates in the U.S. -- provide a worrisome picture of the relationship between student loan debt and the likelihood of graduates starting their own businesses.

Among those who graduated between 2006 and 2015, 63% left college with some amount of student loan debt. Of those, 19% say they have delayed starting a business because of their loan debt. That percentage rises to 25% for graduates who left with more than $25,000 in student loan debt. According to the National Center for Education Statistics, nearly 16.9 million bachelor's degrees were conferred in the U.S. over the past 10 years -- a time frame that mirrors Gallup-Purdue Index analysis of recent graduates between 2006 and 2015.

This translates to more than 2 million graduates saying they have delayed starting a business because of their student loan debt. If even a quarter of them had done so, we would quickly recoup our average surplus of 120,000 new businesses annually.

As colleges and universities ramp up entrepreneurship programs and as the U.S. economy struggles to achieve higher growth rates, these data provide renewed motivation to do everything possible to make college more affordable.