Gallup: In U.S., Uninsured Rates Continue to Drop in Most States

Tuesday, August 11th, 2015

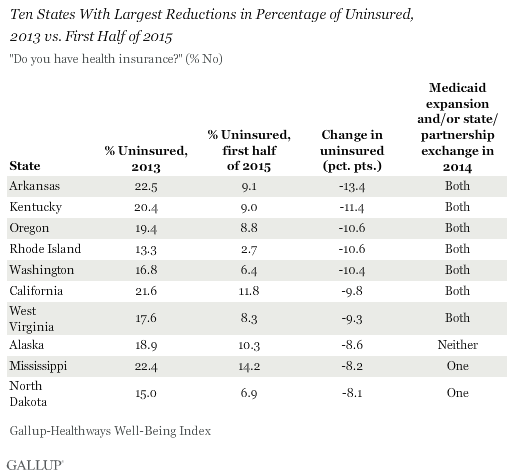

Arkansas and Kentucky continue to have the sharpest reductions in their uninsured rates since the healthcare law took effect at the beginning of 2014. Oregon, Rhode Island and Washington join them as states that have at least a 10-percentage-point reduction in uninsured rates.

Seven of the 10 states with the greatest reductions in uninsured rates have expanded Medicaid and established a state-based marketplace exchange or state-federal partnership, while two have implemented one or the other. The marketplace exchanges opened on Oct. 1, 2013, with new insurance plans purchased during the last quarter of that year typically starting on Jan. 1, 2014. Medicaid expansion among initially participating states also began with the onset of 2014. As such, 2013 serves as a benchmark year for uninsured rates as they existed prior to the enactment of the two major mechanisms of the healthcare law.

Through the first half of 2015, there are now seven states with uninsured rates that are at or below 5%: Rhode Island, Massachusetts, Vermont, Minnesota, Iowa, Connecticut and Hawaii. Previously -- from 2008 through 2014 -- Massachusetts had been the only state to be at or below this rate. No state, in turn, has reported a statistically significant increase in the percentage of uninsured thus far in 2015 compared with 2013. Nationwide, the uninsured rate fell from 17.3% in full-year 2013 to 11.7% in the first half of 2015.

These data, collected as part of the Gallup-Healthways Well-Being Index, are based on Americans' answers to the question, "Do you have health insurance coverage?" These state-level data are based on daily surveys conducted from January through June 2015 and include sample sizes that range from 232 randomly selected adult residents in Hawaii to more than 8,600 in California.

States That Have Embraced Multiple Parts of Health Law Continue to See More Improvement

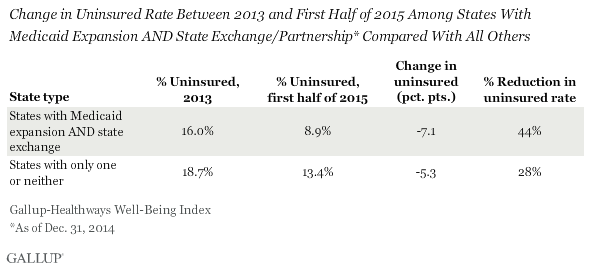

Collectively, the uninsured rate in states that have chosen to expand Medicaid and set up their own state exchanges or partnerships in the health insurance marketplace has declined significantly more since 2013 than the rate in states that did not take these steps. The uninsured rate declined 7.1 points in the 22 states that implemented both of these measures by Dec. 31, 2014, compared with a 5.3-point drop across the 28 states that had implemented only one or neither of these actions.

Although the 22 states that implemented both mechanisms before Jan. 1, 2015, had a lower uninsured rate to begin with, the 7.1-point drop is larger than what is reported among the other 28 states, and represents a 44% decline since 2013 in the uninsured rate among adults residing there. The 5.3-point drop in the 28 states that have implemented one or neither of the mechanisms represents a 28% decline in uninsured rates. Still, the difference in the rate of decline in uninsured rates between the two groups of states has now leveled off, and is unchanged relative to the same 1.8-point gap in the rate of decline measured in midyear 2014.

The end of this article contains a full list of all 50 states, and the 2013 and first-half 2015 uninsured rates for each.

Implications

Americans' attitudes about the law known as "Obamacare" have become more positive in recent months, and now as many Americans approve of the law as disapprove, a shift from the last several years in which disapproval had consistently outweighed approval. This is happening as uninsured rates for most states have continued to decline. The Supreme Court ruling in the King v. Burwell case preserved subsidies for qualifying, low-income adults in states that have defaulted to the federal exchange rather than set up their own locally managed and promoted insurance marketplaces. That decision preserves health insurance for the millions of American adults in those states who have gained health insurance via the federal marketplace in the last two years.

A few states, including Utah, continue to consider Medicaid expansion under modified specifications from what is detailed in the Affordable Care Act. In addition to New Hampshire last August, Indiana and Pennsylvania each enacted Medicaid expansion in early 2015, becoming the 27th and 28th states (plus the District of Columbia) to expand Medicaid. Implementation of this type of expansion in Montana is pending federal waiver approval, and Alaska Gov. Bill Walker has announced that he will proceed with expansion, submitting plans on July 16 to accept federal funds for Medicaid, with a Sept. 1 target date for expansion. While some additional progress can be made, therefore, in the reduction of the uninsured rate via further Medicaid expansion, this mechanism for reduction has likely reached most of its potential unless additional states choose to implement it. As such, the marketplace exchanges that enable people to select and purchase their own plan directly from insurers will likely be the primary means by which the national uninsured rate would be reduced in the immediate future.

Change Analysis Rules

Some states have chosen to implement state-federal "partnership" exchanges, where states manage certain functions and make key decisions based on local market and demographic conditions. For the purposes of this analysis, these partnerships are included with the state exchanges. States with Medicaid expansion that occurred on or after Jan. 1, 2015, were excluded from the "States With Medicaid Expansion and State Exchange/Partnerships" group. For example, Pennsylvania, which manages a state-based exchange but did not enact Medicaid expansion until Jan. 1, 2015, is excluded, while New Hampshire -- which expanded in August 2014 and has been excluded in previous analyses -- qualified for this one. Four states -- North Dakota, New Jersey, Ohio and Arizona -- decided to expand Medicaid without also administering a state-based exchange or partnership, while several others continue to debate expansion. Pennsylvania enacted Medicaid expansion effective Jan. 1, 2015, and Indiana did so on Feb. 1. The District of Columbia, which has expanded Medicaid and has implemented a locally managed exchange, is not included in this analysis.